Glassnode, a leading on-chain data provider, recently tweeted about the dynamics being observed in the cryptocurrency market. The tweet highlighted two key findings: the lack of significant profit or loss associated with coins flowing into exchanges, and the continued growth of bitcoin’s illiquid supply. These observations shed light on the prevailing investor sentiment and the dominant market dynamic of HODLing.

Coins on exchanges – A Stagnant Market

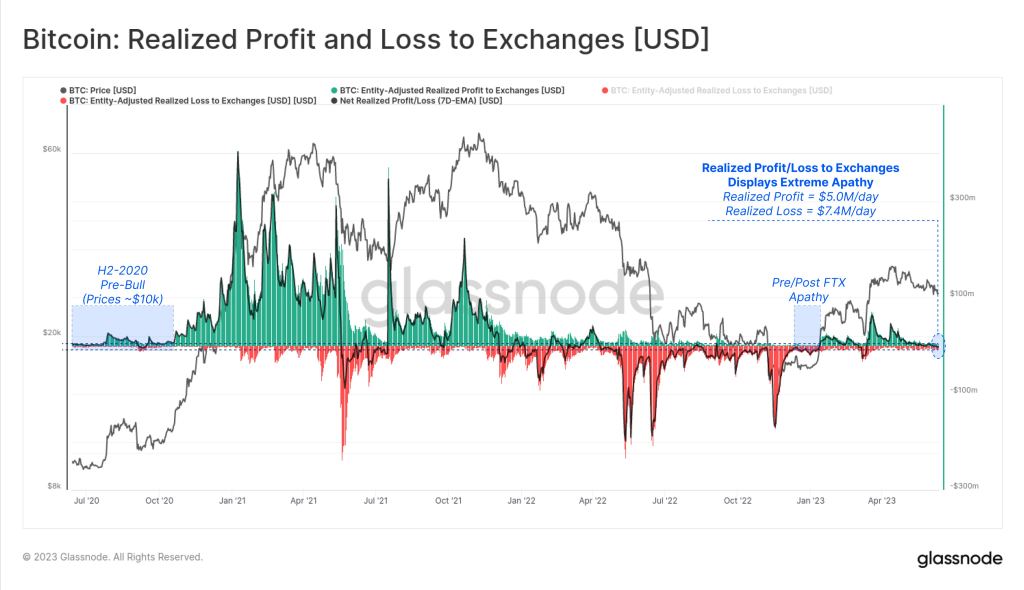

Glassnode’s tweet pointed out that a significant portion of the coins flowing into exchanges were acquired at prices that closely matched the current spot rate. This suggests that many investors who sent their coins to exchanges did so relatively recently, as short-term holders dominate the market. The lack of significant gains or losses implies that these investors are neither motivated to sell nor to capitalize on short-term gains.

Of all the coins flowing into of exchanges, very few of them are locking in any appreciable profit, or loss. In other words, most coins sent to exchanges, were acquired at a price very close to the current spot rate, and likely acquired recently given the dominance of Short-Term… pic.twitter.com/DdWQ0UHWqQ

— glassnode (@glassnode) June 15, 2023

Confidence and Apathy

This market trend reflects confidence combined with apathy among Bitcoin investors. Despite ongoing news and events that typically influence market sentiment, such as regulatory developments or price volatility, investors as a collective are unaffected. The lack of significant profit-taking suggests that they are confident in bitcoin’s long-term prospects and willing to hold their assets in anticipation of future appreciation.

Current prices could play a part in this, too. With bitcoin trading in a relatively stable range, investors may view the potential profits from selling at the current price as insufficient compared to the potential future growth they anticipate. This apathy towards immediate spending further reinforces the prevailing HODLing behavior in the market.

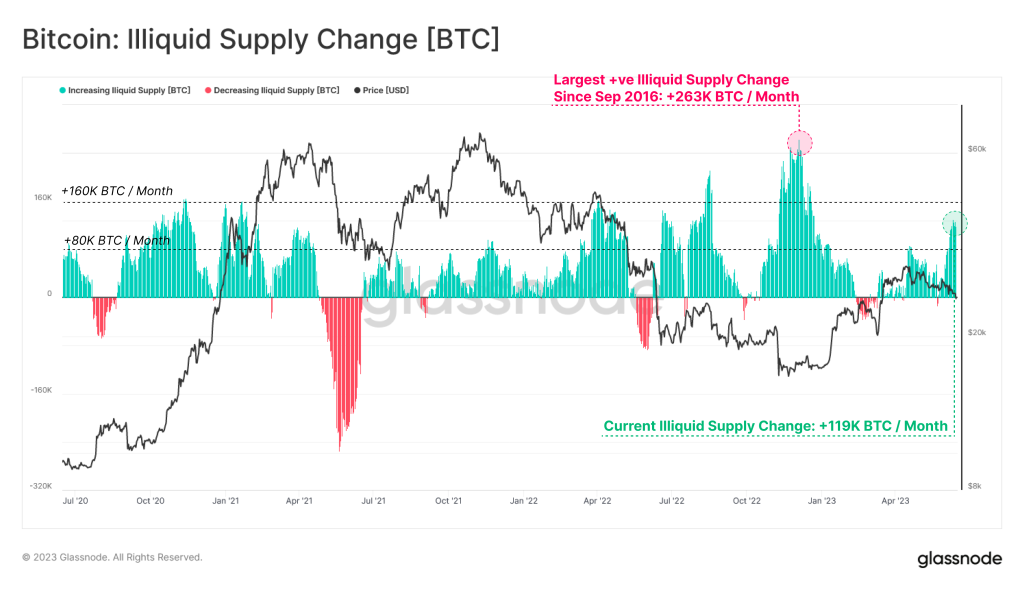

The Growing Illiquid Supply

In addition to the lack of activity on exchanges, Glassnode’s tweet highlighted the continued growth of bitcoin’s illiquid supply. Illiquid supply refers to coins held in wallets that have a limited spending history. The data suggests that investors are increasingly opting to consolidate their holdings into long-term storage solutions, such as cold wallets or hardware wallets, rather than actively trading or transacting.

The concentration of coins in these illiquid wallets further reinforces the dominance of HODLing as the primary market dynamic. Investors who choose to hold their Bitcoin for longer periods of time contribute to the reduction of the circulating supply available for trading. This reduced supply, coupled with continued demand, can be positive for pricing dynamics in the long run.

Impact on The Ecosystem

The prevailing market conditions of confidence, apathy and HODLing have several implications for the broader cryptocurrency ecosystem. First, the resilience and conviction demonstrated by investors signals a maturing market that is increasingly focused on long-term value creation rather than short-term speculation. This long-term mindset is critical to the sustainable growth and adoption of cryptocurrencies.

Second, the concentration of coins in illiquid wallets reduces overall liquidity in the market. However, when market traders/hodlers decide to sell, the impact on supply and demand dynamics may be greater. Understanding these dynamics is becoming increasingly important for traders and investors seeking to navigate the market successfully.

Glassnode’s tweet sheds light on the current state of the bitcoin market, highlighting the confidence, apathy and HODLing behavior of investors. The lack of significant profit or loss associated with coins flowing into exchanges indicates that investors are holding onto their assets in anticipation of long-term appreciation. In addition, the growing illiquid supply suggests a concentration of coins in wallets with limited spending history, reinforcing the dominance of HODLing as the primary market dynamic.