According to the latest research from CCData, spot trading volumes on centralized exchanges showed a promising 16.4% increase in June, breaking a three-month streak of declines. Despite this positive shift, overall trading volumes remain at historically low levels, marking the lowest quarterly figures since Q4 2019. Additionally, the report reveals that Binance, continues to see a steady decline in its market share.

Spot Trading Volume Rebounds, but Remains Historically Low

In June, spot trading volume on centralized exchanges showed a welcome rebound, rising 16.4% month-over-month. This is the first positive movement in spot volume in three months. However, overall trading volumes remain at historically low levels.

Binance’s declining market share

In June, Binance’s spot trading market share fell to 41.6%, the lowest since August 2022. The decline in market share is also seen in Binance’s derivatives trading, which fell to 56.8% in June, marking its lowest market share since October 2022. These figures indicate that Binance is facing increasing competition and challenges from other exchanges.

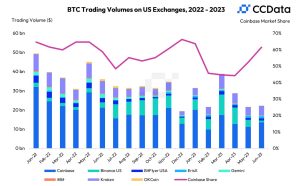

Coinbase Dominates Bitcoin Trading Volume in the US

In the US, Coinbase is emerging as the dominant player in Bitcoin trading volume among registered exchanges. According to CCData research, Coinbase currently represents a significant 61% of bitcoin trading volume in the US. It’s worth to note that the overall contribution of US exchanges to global bitcoin trading volume remains relatively low at 9.49%. Coinbase alone accounts for 5.83% of total global Bitcoin trading volume.

Institutional Interest Boosts CME Derivatives Volume

The CCData report highlights a surge in total derivatives volume traded on CME in June. Derivatives volume rose a remarkable 23.6% to $48.3 billion. Institutional interest was particularly strong in bitcoin futures, where volume jumped 28.6% to $37.9 billion. This is the highest volume recorded on the exchange since November 2021. Institutional participation in the derivatives market signals a growing acceptance and adoption of cryptocurrencies by traditional financial institutions.

Derivatives trading volume on centralized exchanges rebounds

Derivatives trading volume on centralized exchanges saw a welcome rebound in June, rising 13.7% month-on-month. This is the first positive movement in derivatives volume in three months. CCData research also shows that the market share of traded derivatives declined for the first time in four months, falling to 78.7% in June. This decline in market share suggests that decentralized exchanges and alternative trading platforms are gaining traction among cryptocurrency traders.