Two crypto giants, Changpeng “CZ” Zhao of Binance’s former CEO and Roger “Bitcoin Jesus” Ver, face tough legal challenges in the U.S. Their cases spotlighting the intense scrutiny the industry now faces from regulators.

CZ Steps Up to the Plate

Changpeng Zhao just got a reality check with a four-month prison sentence. He pleaded guilty to not having a strong enough anti-money laundering system at Binance, the biggest crypto exchange by volume. Federal prosecutors wanted him behind bars for three years, but he ended up with four months.

After Sam-Bankman Fried who sentenced 25 years behind bars, Zhao is the second crypto boss who is sentenced to prison. Prosecutors have criticized Binance for operating under a “Wild West” model that allegedly facilitated criminal activities, failing to report over 100,000 suspicious transactions linked to designated terrorist organizations such as Hamas, al-Qaeda, and Islamic State. Further allegations include the exchange’s support for the sale of child sexual abuse materials and the reception of significant ransomware proceeds. In response, Binance consented to pay a hefty penalty of $4.32 billion. Additionally, Zhao personally paid a $50 million criminal fine and contributed another $50 million to the U.S. Commodity Futures Trading Commission to settle charges. After all of this CZ stepped down from CEO role.

CZ owned up to his mistakes in court, saying,

I believe the first step of taking responsibility is to fully recognize the mistakes. Here I failed to implement an adequate anti-money laundering program… I realize now the seriousness of that mistake.

He’s set to serve his time at the Federal Detention Center SeaTac in Washington. His case sends a clear message: running a crypto platform means playing by the rules, especially when it comes to money laundering laws.

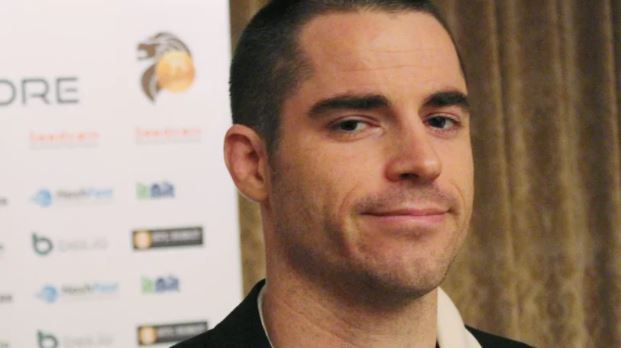

Roger Ver’s Tax Scandal

Meanwhile, according to the Department of Justice announcement on April 30, Roger Ver finds himself in hot water in Spain, arrested for dodging about $48 million in U.S. taxes. He was charged with mail fraud too. After giving up his U.S. citizenship in 2014 for St. Kitts and Nevis, he apparently played fast and loose with the tax rules on his Bitcoin gains.

Ver, once the CEO of the digital wallet developer Bitcoin.com, began acquiring bitcoins in 2011 and became an early advocate for the cryptocurrency, earning the name “Bitcoin Jesus.” His decision to renounce his U.S. citizenship led to significant tax implications under the “constructive sale” principle, where property is considered sold for its fair market value the day before the citizenship is renounced. At the time, Ver and two companies he owned held about 131,000 bitcoins, valued at over $114 million.

Prosecutors allege that Ver provided misleading information to a law firm tasked with preparing his tax returns, leading to the undervaluation of his companies and their assets, including bitcoins. He later took possession of 70,000 bitcoins from the companies and sold them for about $240 million in 2017, without paying the taxes due on these transactions. In total, the IRS was reportedly deprived of $48 million in taxes from 2014 to 2017.

The Justice Department claims Ver misled his tax preparers, leading to massively undervalued tax returns. His lawyer, Bryan Skarlatos, is hitting back, ready to prove Ver was on the up and up:

Mr. Ver relied on professional advice to fulfill his tax obligations. We are prepared to demonstrate his compliance throughout the trial. We look forward to establishing his innocence in court, if necessary.

Skarlatos stated.

What This Means for Crypto

The crackdown on Zhao and Ver could be a game-changer for how the crypto business is done globally. As the industry grows up, it’s clear that the days of the “Wild West” are winding down. Crypto companies need to get serious about following the law or face serious consequences.

Everyone in crypto is watching these cases closely. The outcomes could shape how regulations roll out and how businesses operate in the future. It’s a wake-up call: adapt to the legal standards or get ready for a rough ride.