Ethereum is a decentralized blockchain that brought new opportunities to the cryptocurrency market with its launch in 2015. It’s a revolutionary platform that matches other previous cryptocurrencies in terms of decentralization. Ethereum is a decentralized platform that uses the Ethereum virtual machine to allow decentralized application (dApp) development and execution.

While Bitcoin offered an alternative to traditional financial systems as a new form of virtual currency by allowing faster, more reliable, and cheaper ethereum transactions, Ethereum developed blockchain technology further to broaden its application range. Ethereum also supports complex dApps that open up new opportunities in various industries, playing a significant role in the rise of decentralized finance (DeFi). What made Ethereum unique in the early 2010s? This article will delve into its technology, historical milestones, and the importance of its community.

History of Ethereum – A Decentralized Crypto With True Use Cases

The concept of Ethereum first saw the light of day in 2013, when Vitalik Buterin, one of the founders of Ethereum, envisioned a new platform and publicated its white paper finally in 2014. It was not just another virtual currency, but a full-fledged decentralized application development platform. Although Bitcoin network revolutionised decentralised financial systems, its limitations did not allow it to support complex transactions and applications. These shortcomings led Buterin to create Ethereum, a platform for more versatile and innovative blockchain-based projects.

In 2014, Ethereum launched an ICO (Initial Coin Offerings), raising more than $18 million. By 2015, the Ethereum network was launched under the name “Frontier”. However, the following year was full of challenges. In 2016 their projects Decentralised Autonomous Organisation (DAO), an investment fund set up to finance Ethereum projects attacked. An unknown attacker took advantage of a vulnerability in DAO’s smart contract to steal 3.6 million Ethers worthed about $50 million.

This event caused deep divisions in the Ethereum circle. The community eventually decided to implement a so-called refund fork, which resulted in the creation of a new blockchain where the DAO attack never happened. From this new chain, Ethereum was born, while the original chain that was attacked survived as Ethereum Classic.

2017 brought further developments. Ethereum went through a big update called “Metropolis” which brought two main changes: Byzantium and Constantinople. These updates made Ethereum faster, safer, and easier to adapt to new things. In 2020, Ethereum started a big change called Ethereum 2.0. This change, starting with the Beacon Chain, began shifting Ethereum from an energy-consuming system to a greener and more efficient one.

Now, Ethereum is the second-largest cryptocurrency after Bitcoin. People trade its currency, called Ether, on different platforms, and its rising value shows that more people believe in it. There’s a big community behind Ethereum, with lots of developers making it better. Groups like the Ethereum Foundation also support and help it keep growing and getting better.

In 2023 Ethereum is the second-largest cryptocurrency by market capitalization and we believe the Ethereum mainnet is the second most valuable cryptocurrency.

Difference Between Ethereum and Bitcoin

When Ethereum is mentioned, the metaphor “global computer” is often used because it’s open source . But why does Ethereum stand out in the world of cryptocurrencies?

People often buy Ethereum because of its unique capabilities. Unlike many cryptocurrencies like Bitcoin, which are mainly seen as a store of value, Ethereum offers something extra. Think of it as a digital playground where developers can build and run their own decentralized apps (dApps) without needing a central authority or specific servers. In addition, one of Ethereum’s key technologies is “smart contracting”. These programs execute automatically when certain conditions are met, ensuring transparency and reliability of transactions without the need for a third party.

NFTs: Unique Assets

NFT is a digital asset with unique information on the blockchain, so we can easily verify its owner. Many NFT projects are built on Ethereum protocol. Think of it as a unique piece of digital art. While we can easily copy digital images or videos, we cannot copy NFT because it has a unique identifier.

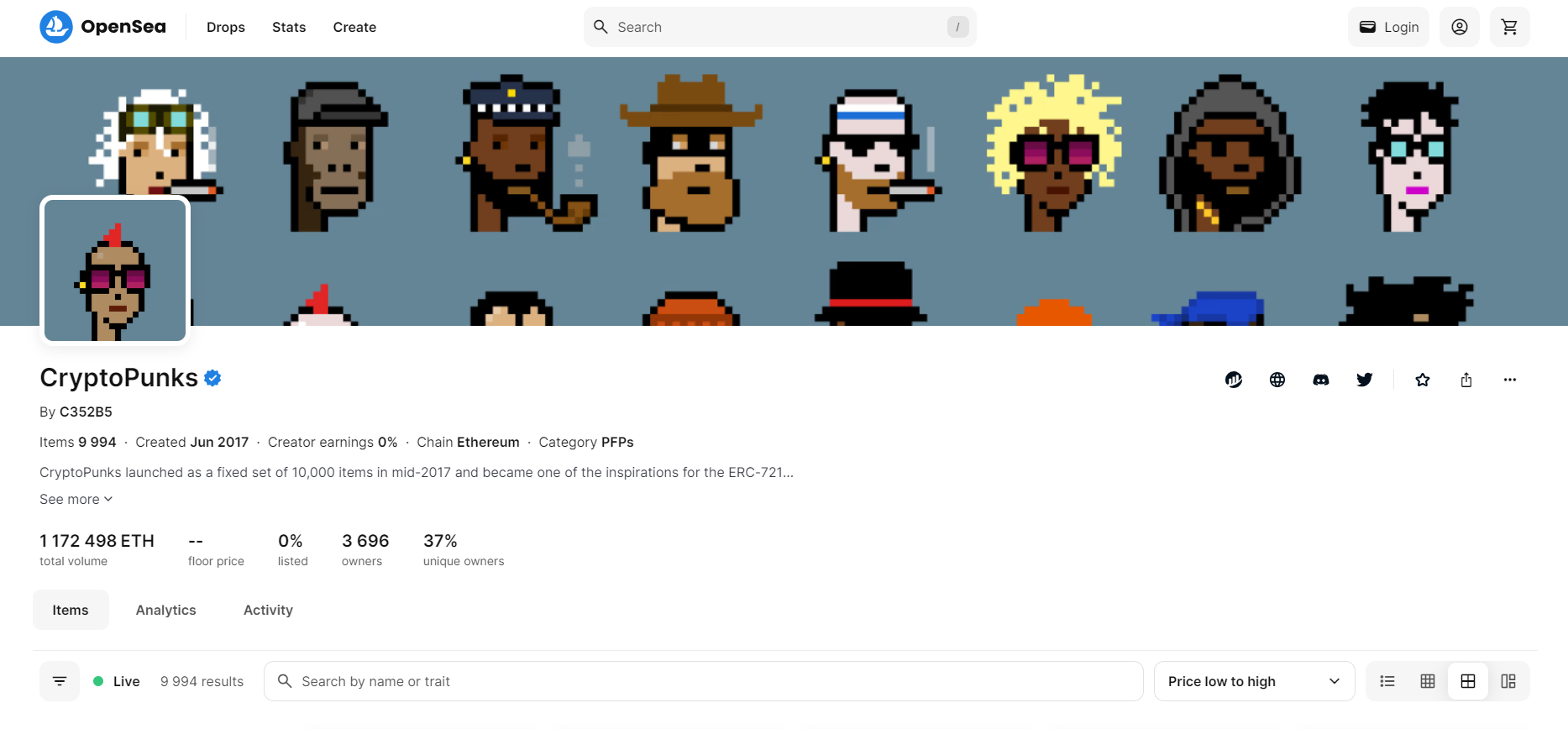

One of the first NFT project in the history was CryptoPunks. This project created 10,000 uniquely generated characters, each 24×24 pixels in size, each unique. These “punks” were distributed for free to members of the Ethereum group in 2017. Today, these simple pixel characters sell for millions of dollars, demonstrating how NFTs have revolutionised the digital art and collectibles market.

NFTs are not only creating value in the art world. These tokens also allow the unique ownership of music albums, video game objects, domain names and many other digital assets.

The Decentralized Applications World (dApps)

Decentralized applications, or dApps, are programs that operates on blockchain technology. Unlike traditional apps where a central authority or server facilitates functions, dApps run on a ledger called the blockchain. These applications are censorship-resistant and, because there is no centralised control, user data is protected from traditional cyber-attacks. Many such applications have been developed on the Ethereum platform, including decentralised financial applications (DeFi), cryptocurrency exchanges, NFT marketplaces and social media platforms.

How Ethereum Works: Beyond Cryptocurrency – Tokens,Smart Contracts

In this section, we describe the features that made Ethereum unique from other cryptocurrencies at the time. We also explain the differences between proof-of-work and proof-of-stake, as well as basic concepts such as “nodes” and “gas fees”.

Tokens and Standards

Tokens on the Ethereum platform are among the digital assets that represent value and function in a specific application or project. These assets can be their own cryptocurrencies, shares for a specific project or anything else that developers envision. The Ethereum platform provides the possibility to create, manage and exchange these tokens in a decentralised way, i.e. directly through the Ethereum blockchain, without any third parties.

There are different standards for tokens on Ethereum, serving different functions and purposes. The most popular of these standards are:

- ERC-20: This standard belongs to those tokens that are interchangeable, i.e. “fungible” tokens. The ERC-20 standard provides a single interface for creating and managing tokens. These tokens are typically used in projects where a token with a fixed value is needed, such as a cryptocurrency wallet.

- ERC-721: This standard allows for the creation of unique, non-substitutable tokens, or non-fungible tokens (NFTs). NFTs are digital assets that are unique and distinguishable from each other. This feature is particularly useful for applications where uniqueness and rarity are important, such as digital art, collections or virtual real estate.

These standards provide a common interface for creating and managing tokens, allowing developers to easily create new tokens or integrate existing tokens into their applications. The flexibility of Ethereum’s system and the presence of these standards allows the cryptocurrency community to create innovative and diversified applications and projects.

Smart contracts

Ethereum introduced something cool called smart contracts. Think of them as digital agreements that do things automatically when certain conditions happen. Imagine having a deal with a friend: they’ll pay you on a specific date. Instead of reminding them or waiting for them to send the money, a smart contract on Ethereum would just do it automatically on that date. So, it’s like a self-running digital promise without needing a middleman, like a bank or lawyer, to make sure it happens.

Why is the smart contract revolutionary?

- Automation: smart contracts automatically and accurately execute the terms they contain.

- Transparency: all smart contracts are publicly available and verifiable on the Ethereum blockchain.

- Security: decentralised blockchain technology ensures that smart contracts cannot be changed afterwards and cannot be affected by external attacks.

- Cost-efficiency: smart contracts eliminate expensive intermediaries, making transactions faster and cheaper.

- Reliability: Because smart contracts are automatic, there is no human factor that can create the potential for error.

Security Model: PoW and PoS

Ethereum originally used a security system called Proof-of-Work (PoW), where computer “miners” raced to solve math problems. The first one to crack it got to add a new block to the blockchain and earned a reward. But, this method started eating up a lot of energy, causing environmental concerns.

To fix this, Ethereum is shifting to a new system called Proof of Stake (PoS). Here, instead of miners, we have “validators” who confirm transactions. But, instead of using energy to compete, they ‘lock-in’ or ‘stake’ some of their own ether to show they’re trustworthy and have something to lose if they act dishonestly.

Why is PoS better?

- Energy efficiency: PoS requires much less energy, as it does not need to perform intensive computational operations to validate the block.

- Greater security: In PoS, attackers need to have a significant amount of ether to cause damage to the system, which is not economically worthwhile.

- More democratic access: while in the PoW system the miners with the highest computational power may dominate, PoS allows the wider community to participate in the validation of the network.

- Ethereum’s move to PoS not only aims to reduce the energy efficiency and environmental footprint of the network, but also ensures that the system will be even more secure, resilient and democratic in the future.

Mining, Nodes and Gas Fees

Ethereum is like a massive, intricate machine with several key parts. One big part is ‘mining’. Miners use their computers to process transactions and smart contracts, competing to be the first to add a new block to the system. When they succeed, they get rewards in coins and another reward known as gas.

The whole system runs on computers called ‘nodes’. These nodes have different jobs. Some, called ‘full nodes’, store all the transaction records, while ‘light nodes’ keep only the key details. Then there are ‘miner nodes’ which focus on the mining part. The system also uses mining to verify the transactions on the network.

And speaking of ‘gas’, think of it as the fuel that powers Ethereum. Every time you do something on Ethereum, like sending money or running a smart contract, you use up some amount of gas, which users pay to the network. The busier the network, the more gas it might cost. This is important because sometimes when lots of people are using Ethereum, the gas fees can get pretty high.

Ethereum Benefits and the Future of Ethereum (2.0)

Let’s dig in what’s the benefits of Ethereum and let’s take a look at the possible future of this cryptocurrency!

Real World Applications of Ethereum

The vast expanse of the Ethereum universe encapsulates a myriad of groundbreaking applications that are revolutionizing the digital realm. Not only does it serve as the backbone for Decentralized Financial (DeFi) giants like Uniswap and MakerDAO, but it also opens the floodgates for innovative Non-Fungible Token (NFT) marketplaces like CryptoKitties and OpenSea.

As an open-source platform, Ethereum acts as a canvas, providing both budding and seasoned developers with a myriad of tools to craft solutions that touch various facets of our digital lives, ranging from entertainment and art to finance and governance.

Challenges and Benefits of Ethereum

Like all pioneering ventures, Ethereum treads a path filled with challenges. The hurdles of scalability, the sting of high transaction fees, and the looming shadow of security vulnerabilities are pressing concerns that the dedicated Ethereum community relentlessly grapples with.

However, when one weighs these challenges against the immense advantages Ethereum brings to the table, it’s evident that its potential is unparalleled. Ethereum’s staunch commitment to decentralization safeguards against unwarranted control and censorship, fostering a resilient and democratic digital landscape.

The Ethereum Community and Developer Network

Ethereum has a super active and involved community. All around the world, they host events like hackathons, workshops, and conferences. It’s where people passionate about Ethereum come to share ideas, learn, and work on cool new things. This strong community spirit is what keeps Ethereum growing and evolving.

Ethereum 2.0

The Ethereum crypto network is evolving. The energy-intensive PoW consensus mechanism and the rise in gas fees prompted the need for an upgrade, leading to the birth of Ethereum 2.0. With Ethereum’s significant market capitalization and widespread adoption, Ethereum 2.0 prepares the network for future challenges, making it faster, safer, and greener. This merge has been already happened on 15th of September in 2022 occured the network able to manage 29 transactions per seconds and developers still promising that in the future 100,000 transactions per second is the target.

We mentioned the PoS consensus mechanism before, but here is an addition: for a solo validation node a user must lock 32 ETH in the system however there are pools that generate that amount with a group of users sharing that “cost”.

The Ethereum community has the chance to vote for changings in the platform with their tokens (the native Ether – ETH coin) and as we can see the changes are going in a good way.

How to Buy Ethereum?

If you want to buy Ether, the easiest way is to use the more well-known exchanges such as Binance or KuCoin.

- Choose a Crypto Exchange: whichever you choose, the first step is to complete the initial validation and registration processes.

- Choosing an External Wallet: however you can store your Ether on the exchange, we recommend you for safety to choose an external wallet. We wrote a detailed article about this topic here (Bitcoin is like Ethereum in terms of storability).

- Complete the Purchase: after registration, you can easily deposit in fiat currency, as Visa and Mastercard transactions are accepted almost everywhere. However, because ot the transaction fee could vary, check them to choose the best option for you!