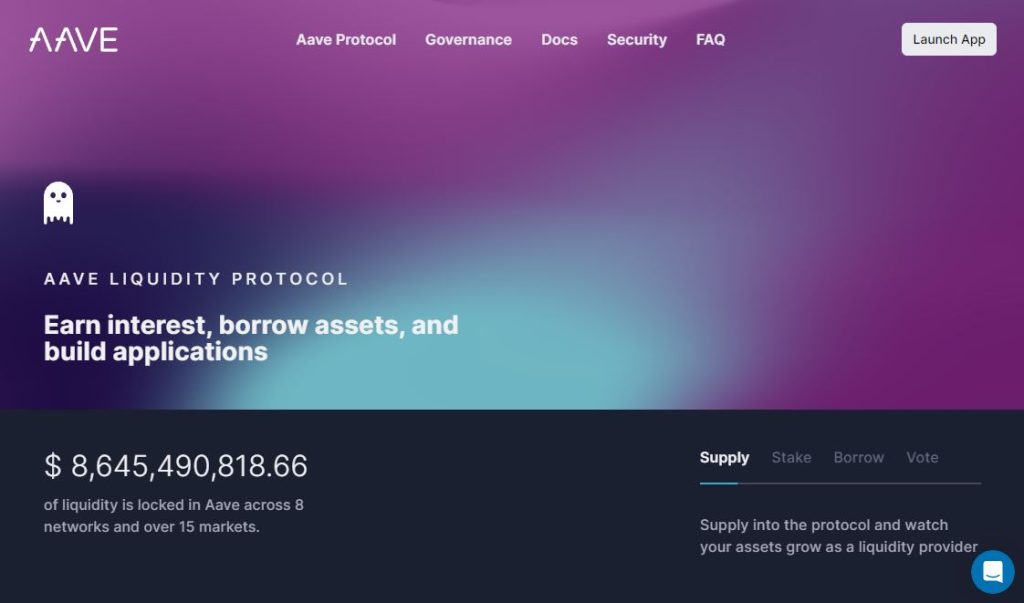

In this article we explain everything you need to know about the Aave crypto lending platform. A place where allowed the users, lenders and borrowers make crypto loans. At the time of writing Aave is one of the largest decentralized finance (DeFi) platform allowing lend crypto. So let’s go and find out together what is Aave!

What is Aave? – One of The Largest Decentralized Finance (DeFi) Platform

Aave is a decentralized lending platform. It allows users to lend or borrow cryptocurrencies without a traditional financial intermediary, such as a bank. This platform works on the Ethereum blockchain, making sure security and transparency by using smart contracts. These contracts make the borrowing process automated by calculating the loan terms, collecting the deposited collateral, and distributing the cryptocurrency being borrowed.

The platform’s unique features like flash loans, which are uncollateralized loans that must be repaid in the same transaction, and interest-bearing “aTokens,” that generate interest in real-time. Anyone with an Ethereum wallet can access these services. Its native token is the AAVE. It can be used to earn rewards from staking on the platform and it’s available on most crypto exchanges.

Aave uses liquidity pools that means borrowers can borrow from these pools made by the lenders instead of direct matching the two parties.

History of Aave Protocol

The project was created as ETHLend, a basic lending platform launched in 2017 by Stani Kulechov, a law student in Helsinki. He made an initial coin offering (ICO) with the former LEND tokens and raised $16.2 million. It rebranded to Aave in 2018. That was the moment when the platform changed from peer to peer lending and borrowing to smart contracts.

How Aave Works – To Lend and Borrow

As we mentioned before, anyone can use Aave with an Ethereum wallet. MetaMask could be an easy way to do it as it is a wallet can be plugged-in most browsers or use it as a mobile wallet. But let’s see how exactly lending and borrowing works.

Lenders

Users who wish to lend their cryptocurrencies can deposit them into the platform. Upon deposit, they receive “aTokens” in return, which represent their deposited asset. These aTokens earn interest over time, with the rate depending on the demand for borrowing that specific cryptocurrency. This interest is what is known as the Annual Percentage Yield (APY). APY is the rate of return that lenders earn for depositing their digital assets into the platform. It is also the rate that borrowers pay for taking out a loan.

Borrowers

Borrowers can take out loans by providing collateral with other cryptocurrencies. The platform offers a variety of cryptocurrencies for borrowing and lending, including popular ones like Ethereum (ETH) or Bitcoin (BTC). The amount one can borrow depends on the value of their collateral, and borrowers must maintain a certain collateralization ratio to avoid liquidation. Interest rates for borrowers vary based on the asset and the current market demand.

What Are Overcollateralized Loans?

In the platform, most loans are overcollateralized. This means that borrowers must deposit a higher value of assets than the amount they want to borrow. This overcollateralization is a risk management tool that save the lender and the platform from potential losses due to market volatility or default by the borrower.

For example, if a user wants to borrow $1,000 worth of a cryptocurrency, they might need to provide $1,500 worth of another cryptocurrency as collateral. This excess collateral acts as a buffer against market fluctuations. If the value of the borrowed asset rises significantly or the collateral’s value falls, the loan maintains a safe loan-to-value (LTV) ratio, reducing the likelihood of liquidation.

If the LTV ratio becomes too high (meaning the loan is at risk due to falling collateral value), Aave’s system will initiate a liquidation process to protect the lenders. The borrower’s collateral is sold to repay the loan, making sure the lender’s assets are secured.

What Are Flash Loans?

Aave flash loan is a unique feature of the Aave platform, representing a new concept in DeFi. These loans are designed for advanced users who understand the nuances of blockchain transactions and DeFi protocols.

A flash loan allows a user to borrow a large amount of cryptocurrency without providing any collateral. The catch is that the loan must be borrowed and repaid in the same blockchain transaction. To make it simple: a user takes out a loan and must return it, with a small fee, doing it in a few seconds.

This might sound confusing at first, but here’s how it works: a “transaction” can consist of several complex operations. During a flash loan, a borrower can use the borrowed funds for other DeFi activities (like arbitrage, collateral swapping, or self-liquidation) and repay the loan by the end of the transaction. If the loan is not repaid, the entire transaction is reversed as if it never happened, making sure no risk to the funds in the Aave system.

Flash loans are particularly useful for those looking to take advantage of quick arbitrage opportunities, where a trader can profit from price differences of the same asset on different exchanges. They are also used for swapping collateral in other DeFi positions without closing them.

Aave’s Crypto – The AAVE Token

The token is an integral part of the Aave ecosystem, serving several key functions that are central to the platform’s operations and governance. This token is used as a utility and governance token, AAVE plays a key role in guarantee the platform’s decentralization and functionality.

Governance

AAVE token holders have the privilege of participating to govern the platform’s life. This means they can propose, vote on, and make decisions about changes to the platform, including upgrades, new features, and adjustments to key parameters. This governance model empowers token holders with a significant say in the direction and evolution of the platform.

Collateral for Loans

In the Aave ecosystem, its token can also be used as collateral for loans. This adds an extra layer of utility to the token, as it allows holders to borrow against their AAVE holdings without having to sell them. This feature is particularly useful for users who wish to maintain their investment in AAVE while accessing liquidity.

Staking

Another critical function of the AAVE token is staking. Users can stake their AAVE tokens in the platform’s safety module, which acts as a sort of insurance mechanism. In return for staking their tokens, participants earn rewards, typically in the form of additional AAVE tokens. This staking process not only provides an incentive for holding the token but also improves the security and stability of the Aave platform. When a deficit caused by unexpected issues, the staked tokens can be used to cover the deficit.

Does It To Use Aave Safe?

While the platform offers innovative financial services, users must be aware of several risks. Understanding these risks is key for anyone considering using the platform, especially given the volatile and often unpredictable nature of cryptocurrencies.

Liquidity Risk Without Insurance

Liquidity risk comes when there isn’t enough liquidity in the pool to cover withdrawals or loans. If many users decide to withdraw their assets at the same time, or if there’s a high demand for loans that the pool cannot satisfy, it could lead to issues in accessing funds.

Unlike traditional banks, funds deposited in the platform are not insured. In the traditional banking system, governmental bodies often insure deposits up to a certain amount, providing a safety net for depositors. However, in the DeFi space, no such insurance exists. If the platform suffers from a hack, a bug in the smart contract, or other unforeseen events leading to a loss of funds, users have no recourse to recover their assets.

How to Buy Aave

- Choose a Cryptocurrency Exchange: Select an exchange that lists AAVE, like Binance or Coinbase.

- Create and Verify an Account: Sign up and complete any required KYC (Know Your Customer) processes.

- Deposit Funds: Transfer fiat money or cryptocurrency to your exchange wallet.

- Buy AAVE: Trade your deposited currency for AAVE.

- Secure Store Your Tokens: Consider transferring your tokens to a secure wallet, such as a hardware wallet for added security. Read our article about crypto wallets here to learn more!