In the world of decentralized finance (DeFi), a question often asked: “what is yield farming”? Yield Farming is a method of generating returns by participating in the DeFi ecosystem, specifically through DeFi lending and trading protocols.

These platforms often use the concept of liquid staking, where users lock up their digital assets to provide liquidity and in turn, earn rewards. It’s dynamic and integral, where participants can use different strategies to maximize their farming returns. Whether it’s through participating in liquidity pools, staking in governance tokens, or exploring new DeFi platforms, this farming method presents a world of opportunities for crypto enthusiasts and investors.

What is Yield Farming?

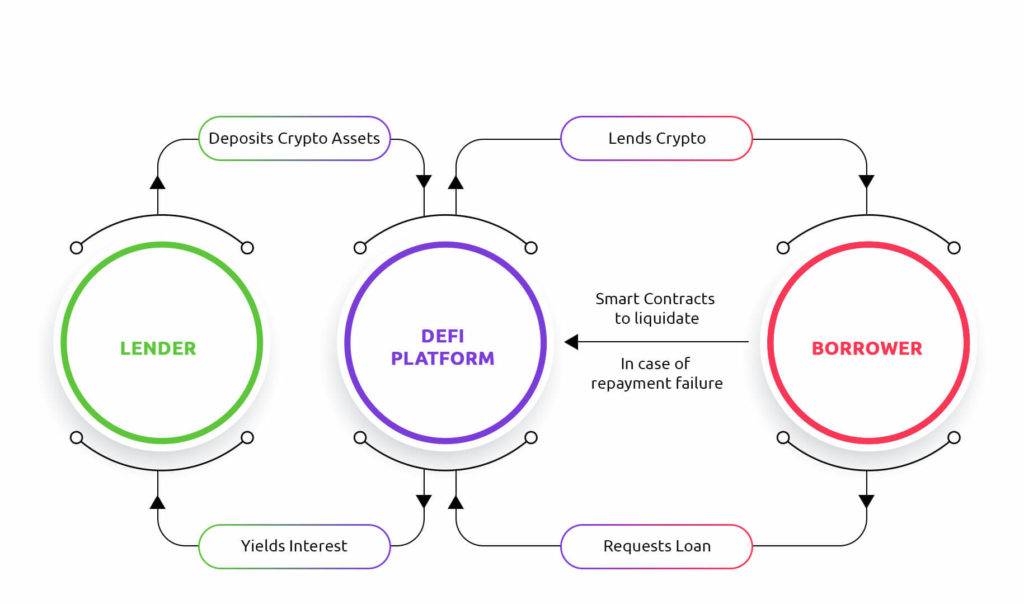

Yield farming is a financial strategy in the crypto market, where you can earn yield (reward) by investing your cryptocurrency holdings. It involves depositing tokens into a liquidity pool on a DeFi platform, with rewards typically paid out in the protocol’s governance token.

The methods of yield farming vary between farming platforms, but the most common forms include depositing crypto assets into decentralized lending or trading pools, often providing liquidity to decentralized protocols. These pools are fundamental to the DeFi ecosystem, allowing multiple financial transactions like token exchanges or loans without a central intermediary. By adding to these pools, participants, known as liquidity providers (LPs), help maintain and stabilize the platform’s liquidity.

In return for their deposited funds, LPs receive rewards, often in the form of an annual percentage yield (APY). This yield is typically higher than traditional banking products, reflecting both the innovative nature and the increased risk associated with DeFi. The APY can vary based on several factors, including the platform’s overall usage and the liquidity of the specific pool.

DeFi projects promote yield farming as a way to earn and motivate the use of their platforms. By rewarding community members for providing liquidity, these projects can provide a more robust and powerful ecosystem. This reward mechanism increases participation and creates a sense of community and mutual benefit among users. As a result, yield farming has become a popular way for crypto enthusiasts to potentially increase their digital asset holdings.

Differences Between Yield Farming and Defi Yield Farming

The terms of “yield farming” and “DeFi yield farming” are often used synonymously, but there are differences that are important to understand. Yield farming refers to the practice of earning returns on crypto assets through various mechanisms, not limited to the DeFi space. This could include rewards from staking on different blockchain platforms or other crypto earning activities.

When doing yield farming, especially in the DeFi context, using a secure crypto wallet is crucial to protect assets against potential rug pulls and price volatility.

DeFi yield farming, on the other hand, is specifically connected to the DeFi ecosystem. It focuses on earning rewards through providing liquidity in DeFi protocols, which are typically built on blockchain networks like Ethereum. This form of yield farming is deeply integrated with the functionalities of DeFi platforms, such as lending, borrowing, and trading through decentralized exchanges (DEXs).

DeFi yield farming strategy often involve complex interactions between multiple DeFi platforms, using complex financial tools like liquidity pools, automated market makers, and smart contracts.

How Does Yield Farming Work?

Yield farming operates on a set of principles that combine traditional finance concepts with the innovative features of the blockchain and DeFi world. To understand how yield farming works, let’s walk through a step-by-step example using Uniswap, a popular decentralized exchange platform that uses Ethereum blockchain. It offers various liquidity pools, each corresponding to a pair of cryptocurrencies.

The farmer provides liquidity to one of these pools. For example, if they choose an ETH/DAI pool, they need to deposit both Ethereum (ETH) and DAI (a stablecoin) in equal value. By doing this, they become a liquidity provider (LP). By participating in this process, yield farmers maximize returns by putting their tokens in the pool, which is essential to the functioning of the automated market maker system.

After depositing their assets, the farmer receives liquidity pool tokens. These tokens represent their share of the pool and can be used to reclaim their share, plus any fees earned, upon exiting the pool.

As trades are executed in the pool, a small fee (usually 0.3% on Uniswap) is charged on each transaction. These fees are distributed proportionally to all liquidity providers in the pool, based on their share.

On top of transaction fees, some pools offer additional rewards, often in the form of the platform’s governance token. In Uniswap’s case, this could be the UNI token. These rewards can provide an extra motivator for liquidity providers.

It’s important to understand the risks involved, particularly impermanent loss. This happens when the prices of the deposited assets change compared to when they were deposited, potentially leading to a temporary loss if the tokens are withdrawn at a lower relative price.

Yield farmers need to actively monitor the performance of their investments. They may choose to adjust their strategies, moving assets to different pools or platforms, based on changing APYs and market conditions.

Benefits and Risks of Yield Farming

Yield farming offers a unique set of benefits and risks that are important for participants to understand.

Benefits of Yield Farming

One of the most attractive aspects of yield farming is the potential for high returns, often significantly higher than traditional financial investments. The annual percentage yield (APY) can be much higher, especially in new pools or platforms offering additional rewards.

Yield farming allows users to diversify their crypto portfolio. By participating in different liquidity pools over various DeFi platforms, farmers can spread their risk and potentially increase their overall returns.

Yield farmers play a critical role in providing liquidity. This liquidity supports a range of financial services, including decentralized exchanges (DEXs), lending, and borrowing.

Many DeFi platforms reward liquidity providers with governance tokens, which can grant voting rights or a stake in the platform’s future. This provides an opportunity to be involved in developing DeFi projects.

Risks of Yield Farming

Volatility loss is a significant risk in yield farming, particularly in volatile markets. it occurs when the price of the deposited assets changes compared to when they were deposited, leading to potential losses if the assets are withdrawn at an unfavorable price.

Since yield farming is based on smart contracts, any bugs or vulnerabilities in the contract code can lead to loss of funds. The decentralized nature of these platforms means there’s often little recourse if something goes wrong.

The cryptocurrency market is known for its high volatility. This can impact the value of rewards in yield farming, as the value of governance tokens or other incentives can swing wildly.

Regulation is an other risk. Changes in regulatory frameworks could impact the functioning of DeFi platforms and the legality of certain activities associated with yield farming.

Yield farming can be complex and requires a good understanding of the DeFi sector. For beginners, the learning curve can be long, and mistakes can be costly.

Popular Yield Farming Protocols

It has become popular with numerous protocols offering various opportunities for farmers. Here are some of the most popular yield farming protocols in the DeFi space:

- Uniswap: As one of the leading decentralized exchanges (DEXs) on the Ethereum blockchain, it offers users the ability to trade cryptocurrencies without a central authority. It also allows for yield farming by providing liquidity to different trading pairs.

- Curve Finance: Specializing in stablecoin trading, Curve Finance offers low slippage and minimal impermanent loss, making it a favored choice for yield farmers, especially those dealing with stablecoins. It rewards liquidity providers with fees and its own governance token, CRV.

- Compound: Compound is a lending protocol that allows users to earn interest on their crypto by lending it out or depositing it into a liquidity pool. Yield farmers earn COMP tokens as a reward, in addition to the interest generated.

- SushiSwap: Originally a fork of Uniswap, SushiSwap has evolved to offer unique features like SUSHI tokens, which provide a share of the exchange’s fee revenue to token holders.

- PancakeSwap: Operating on the Binance Smart Chain, PancakeSwap is known for its lower transaction fees compared to Ethereum-based protocols. It offers yield farming opportunities with its native CAKE token and other crypto pairs.

Each of these protocols has its unique features, rewards, and risks. The choice of protocol depends on the yield farmer’s strategy, risk tolerance, and the types of crypto assets they hold. As the DeFi space continues to evolve, these protocols adapt and grow, offering diverse opportunities for those interested in yield farming.