Solana, renowned for its exceptional performance and emphasis on supporting a high-quality network, faces challenges like staking costs, security concerns in centralized exchanges, and mempool inefficiencies. Jito, a top liquid staking and MEV protocol on Solana, addresses these, boosting Solana’s development and performance of the Solana network.

Jito, like Ethereum’s Lido, gained attention with its substantial airdrop in December 2023, rewarding JTO tokens to JitoSOL holders, Solana validators using Jito’s MEV clients, and MEV service users. This even if Jito freshened up Solana’s ecosystem, visibly increasing its total value locked (TVL) as Jito gained popularity, demonstrating how Solana benefits from stake pools. This guide delves into Jito, the liquid staking protocol on Solana and the JTO tokens, highlighting Jito’s essence and the excitement around JTO trading potential.

What Is Jito Network?

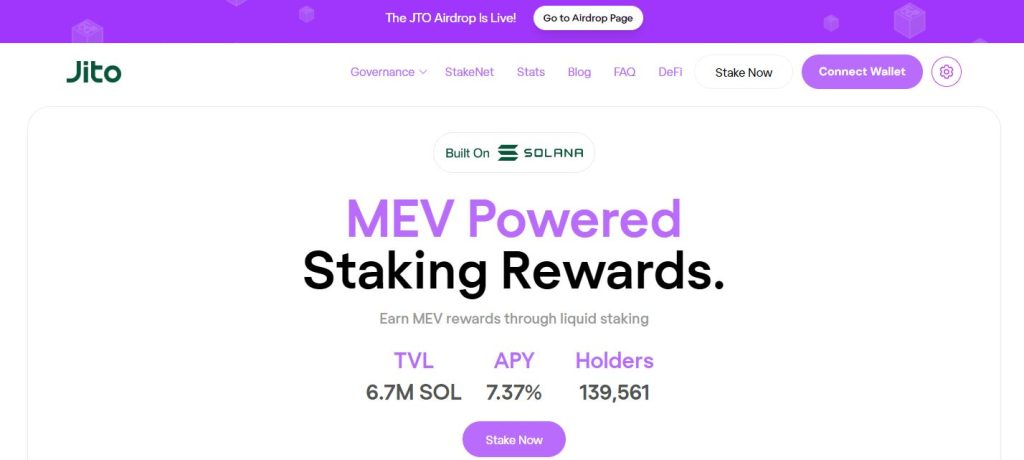

Jito, works as a liquid staking platform on Solana with a stake pool model. A stake pool contains one or more validator nodes. With Jito the users can deposit SOL tokens so they delegate their SOL tokens to the pool. For this they receive JitoSOL tokens in exchange, and maintain stake pool ownership and rewards. JitoSOL’s flexibility allows trading, transfers, and usage in various decentralized inance (DeFi) activities without compromising staking positions or rewards. Jito uses MEV strategies to boost stake pool returns, sharing benefits with JitoSOL holders. Jito’s integration of liquid staking, DeFi, and MEV creates a rewarding Solana staking experience.

Jito’s stake pool comprises 163 validators, collectively staking over 6.5 million SOL tokens, chosen for their MEV support, block participation, low commission rates, delinquency rates, independence from dominant validator groups, avoidance of risky consensus changes, and single validator operator commitment. These criteria makes sure backing high-quality validators and promoting Solana network’s decentralization. These validators, selected with stringent validator selection and fees criteria, making sure Jito’s primary objective of maximizing returns and security for its users.

How Does Liquid Staking Works?

Liquid staking or “soft staking”, entails locking up assets to garner rewards, while still maintaining access to these assets. This differs from traditional proof-of-stake (PoS) staking, where assets are fully committed in a protocol. In liquid staking, assets remain accessible, typically held in an escrow-like arrangement. Platforms engaging in liquid staking issue alternative tokens to stakers, serving as proof of their staked assets. These tokens, termed Liquid Staking Tokens (LSTs) or Liquid Staking Derivatives (LSDs), mirror the value of the original assets. The standout feature of LSTs or LSDs lies in their adaptability – they can function as collateral, and are tradable or transferrable across different blockchain platforms, providing users an opportunity to grow their assets through staking and MEV.

In this process, liquid staking effectively bridges the gap between asset security and functional liquidity. By integrating with DeFi platforms, these tokens unlock new avenues for users to generate income, be it through interest in lending protocols or yield farming. This model not only optimizes capital efficiency but also enhances the utility of the underlying assets, allowing users to grow their assets through staking and engaging in various DeFi activities. The approach to staking, therefore, transforms from a static asset holding to a dynamic tool for asset growth and diversification.

Furthermore, the emergence of liquid staking platforms like Jito on the Solana blockchain has revolutionized the concept, especially in terms of offering additional returns for holders. JitoSOL, as a form of LSD, underscores this innovative approach, extending beyond traditional staking rewards to include benefits from maximal extractable value (MEV) strategies. This not only provides high yields for JitoSOL holders but also plays a key role in shaping the future of staking in the Solana ecosystem.

By operating on a non-custodial basis, these platforms guarantee the safety and autonomy of user assets. The integration of liquid staking with MEV strategies further underscores the potential of these platforms to distribute MEV rewards and enhanced returns to their users.. This, in turn, strengthens the overall health and performance of the blockchain network, making liquid staking a cornerstone in the ongoing evolution of the DeFi sector.

What Is MEV?

MEV, standing for Maximum Extractable Value, is all about tweaking transactions in a new block for blockchain inclusion to boost profits. Think of it as a smart move by miners, validators, arbitrageurs, or front-runners to play the market gaps, beat network traffic jams, or leverage the info gap. Sure, MEV’s got its downsides like higher gas fees, less security, and not-so-fair play for users, but on the flip side, it can make the network more efficient, cut down on spam, and spice up staking incentives.

Now, let’s talk about Jito’s cool tools tackling MEV head-on. The Jito-Solana Validator Client, operating on a stake pool model, is a tweaked Solana validator software jazzed up to pull MEV and spread it around. There is also the Jito Labs Block Enging which you could picture as a smart contract hosting a bidding war for every block. MEV seekers pitch their best transaction combos, and this engine picks the lineup that’s a win-win for both the validator and the stakers. And finally the Jito Relayer, this server’s the gatekeeper, checking out bids from MEV hunters and passing the good stuff to the Block Engine and validator.

Using Jito’s toolkit, validators and stakers on the Solana network can grab their share of MEV profits. Jito stakers, meaning you JitoSOL holders, get a slice of the MEV cash pie on top of regular staking rewards and MEV rewards. It’s like giving staking yields for SOL holders a mega boost while spreading the love (and stakes) across the Solana network, making it more decentralized.

The JTO Token And The JTO Airdrop

JTO, a governance token, serves as the key for the Jito protocol, empowering users to join the Jito DAO. They get a say in major choices impacting the protocol and its offerings. This covers crucial stuff like setting fees, tweaking delegation strategies, treasury management, and chipping in on the protocol and product development and enhancement. It’s all about keeping governance decentralized, transparent, and community-led.

JTO tokens are pretty versatile. Here’s what you can do with them:

- MEV Shareholding: Holding JTO lets you get a piece of the MEV revenue pie. Thanks to the Jito Block Engine, which smartly organizes and executes transactions on the Solana blockchain, this is possible.

- Community Perks: With JTO, you’re not just holding a token; you’re unlocking doors to exclusive Jito community events, juicy airdrops, early peeks at cool new features, and connecting with fellow Jito fans.

- DeFi Adventures: Dive into the DeFi world using JTO tokens for trading, lending, borrowing, yield farming, or providing liquidity. It’s all about making the most of the Solana ecosystem’s liquidity and composability.

- Future Staking Pools: There’s buzz about exclusive JTO-only staking pools with potentially fatter rewards. Still hush-hush, but it’s something to look forward to.

- Staking Multiplier Magic: JTO might soon let you boost your JitoSOL staking rewards. It’s in the pipeline, so details are sketchy, but the potential is exciting.

JitoSOL holders got a treat with the JTO airdrop, thanks to a point system launched in September 2023. Points racked up since early 2023, with daily rewards for each JitoSOL token held. Jito cleverly split users into 10 tiers based on points, with rewards ranging from 4,941 JTO for the lowest tier to a whopping 104,391 JTO for the top tier.

The cool thing? This airdrop favored the little guys, giving smaller wallets a more significant share. The community loved this, applauding Jito’s nod to the smaller players in DeFi.

Now, for informational purposes, the JTO airdrop claim period is live on Jito’s site until June 7, 2025. It’s a breeze to check eligibility and claim your JTO tokens – just hook up your wallet to the site, and you’re good to go.