Uniswap Foundation announced that the Uniswap v4 is expected at the Q3 of 2024. As the v4 launch depends on Ethereum’s Dencun upgrade there isn’t a concrete date for it. In this article we give you a detailed introduction to Uniswap, especially on v4 and its features like hooks, the singleton contract, native ETH trading and even more.

What Is Uniswap?

Uniswap protocol is a decentralized exchange (DEX) running on the Ethereum blockchain. The protocol allows users to swap different cryptocurrencies without a middleman. In this way trades are faster, more private and cheaper than traditional exchanges.

But what makes Uniswap v4 stand out? Its new features and improvements (compared to Uniswap v1, v2 and v3) offer improved user experience, security, efficiency, and even faster transactions, lower fees (reduced gas costs), and more opportunities for traders and liquidity providers alike.

Uniswap v4 remains true to the principles by allowing users to maintain control over their funds at all times. As it operates on a blockchain, it guarantee that all transactions are transparent and immutable.

How Does Uniswap v4 Works?

Uniswap v4 functions like a digital marketplace but for cryptocurrencies. But here’s no central authority overseeing transactions. Instead, it uses Automated Market Maker (AMM), which facilitate trades by liquidity pools and smart contracts.

Each liquidity pool is like a large pot of funds with a token pair. These guarantee trading on Uniswap v4, so the users can swap one cryptocurrency for another. The users who deposit their cryptocurrencies into these pools are known as liquidity providers. They offers the funds needed for trades and, in return, earn transaction fees as rewards.

The process of swapping currencies on Uniswap v4 is straightforward and automated, thanks to smart contracts. These are programs that run on the blockchain, executing trades based on predefined rules without any human intervention. They making sure every transaction is secure, transparent, and adheres to the agreed terms.

Price determination in Uniswap v4 is a direct result of the trading activity in these liquidity pools. It follows a mathematical formula that balances the supply and demand for the cryptocurrencies in the pool, adjusting prices automatically as trades are made. This pricing mechanism guarantees that the market price stays fair and current.

After each transaction a small fee is charged. This fee is distributed among the liquidity providers. This mechanism incentivizes more users to deposit their assets, to increase the liquidity and efficiency of the platform.

By focusing on user-friendly design and leveraging blockchain technology, Uniswap v4 offers a powerful platform for cryptocurrency trading that is accessible, efficient, and secure. Its approach to automated trading represents an advancement in the DeFi space.

The Improvements Over Uniswap v3 – “Hook”, Singleton Design and More

Uniswap v4 brings some cool upgrades from the last version, making things better for everyone who uses it. Let’s break it down into simpler terms.

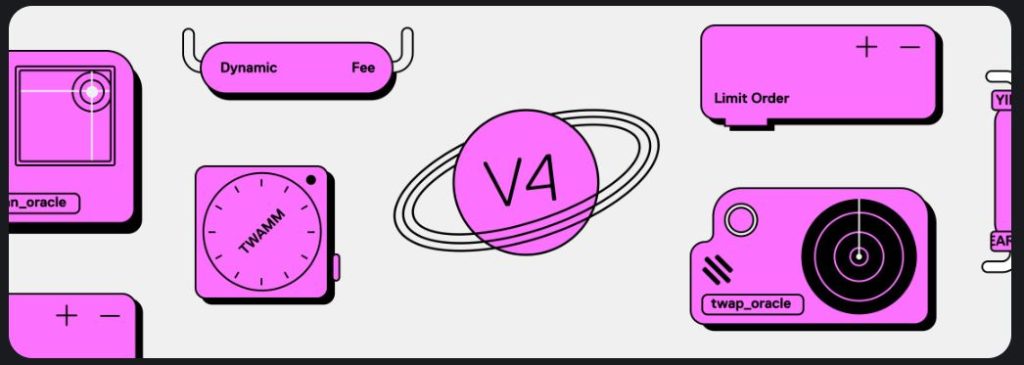

First off, there’s this new thing called the “hook”, a feature enabling customization at different stages of a liquidity pool’s lifecycle, allowing developers to integrate specific actions throughout its existence, from creation to adjustments in liquidity. These “hooks” empower developers to embed code that activates at crucial moments, enabling functionalities like native dynamic fees, on-chain limit orders, or operating as a time-weighted average market maker (TWAMM). This innovation facilitates the distribution of large orders over time, reducing their impact on market prices and enhancing the pool’s efficiency and adaptability.

Now, about connecting to Ethereum—both Uniswap v3 and v4 are buddies with Ethereum, but v4 has upped its game. It’s got better connections to Ethereum’s second layer, which is like a fast lane for transactions. This means you can do your trades faster and it won’t cost you as much.

Speaking of saving money, Uniswap v4 is also smarter about gas costs. It’s like finding a way to run your car on less fuel. This is great news because it means doing trades on Uniswap v4 doesn’t hit your wallet as hard.

Uniswap V4’s adoption of the singleton design works hand in hand with a new feature known as flash accounting, streamlining operations and cutting costs. Unlike earlier versions where every action, like swapping tokens or contributing liquidity, concluded with immediate token transfers, V4 consolidates these transfers to the end of transactions. This efficiency, coupled with the singleton approach and flash accounting, significantly improves the cost-effectiveness and routing across various pools. With the “hooks” feature potentially increasing the number of liquidity pools, these enhancements become particularly beneficial, optimizing the overall performance and economic feasibility of the platform.

The oracle system got a boost too. Oracles are like the messengers that tell you what the current price of something is. So they provide data from off-chain, like weather, or sport results. In Uniswap v4, they’re more on the ball, giving you better info for making decisions.

Uniswap v4 also added more on-chain functionalities. This is tech speak for being able to do more stuff directly on the blockchain, like setting up trades that execute automatically under certain conditions.

Pool creation is easier too. This encourages more people to get involved, making the whole system richer and more diverse.

And there’s great news for Ethereum fans. You can now trade Ethereum more smoothly on Uniswap v4, without converting it into a different format first. Just like being able to spend your dollars anywhere, without having to change them into euros or yen.

V4 introduces more options for trading pairs, including some you might not find elsewhere, and introduced limit orders. So you can set the price you want to buy or sell at and wait for the market to match it. It gives you a lot more control over your trades.

All these changes make Uniswap v4 safer and more user-friendly. It’s like the platform got a major upgrade, making it easier for newbies to jump in while still offering the depth that experienced traders love.

So, with all these improvements, it sets new standards for how decentralized exchanges should work, making things faster, cheaper, and more secure for everyone. It’s a big leap forward for people who want to trade, invest, or build in the DeFi space.