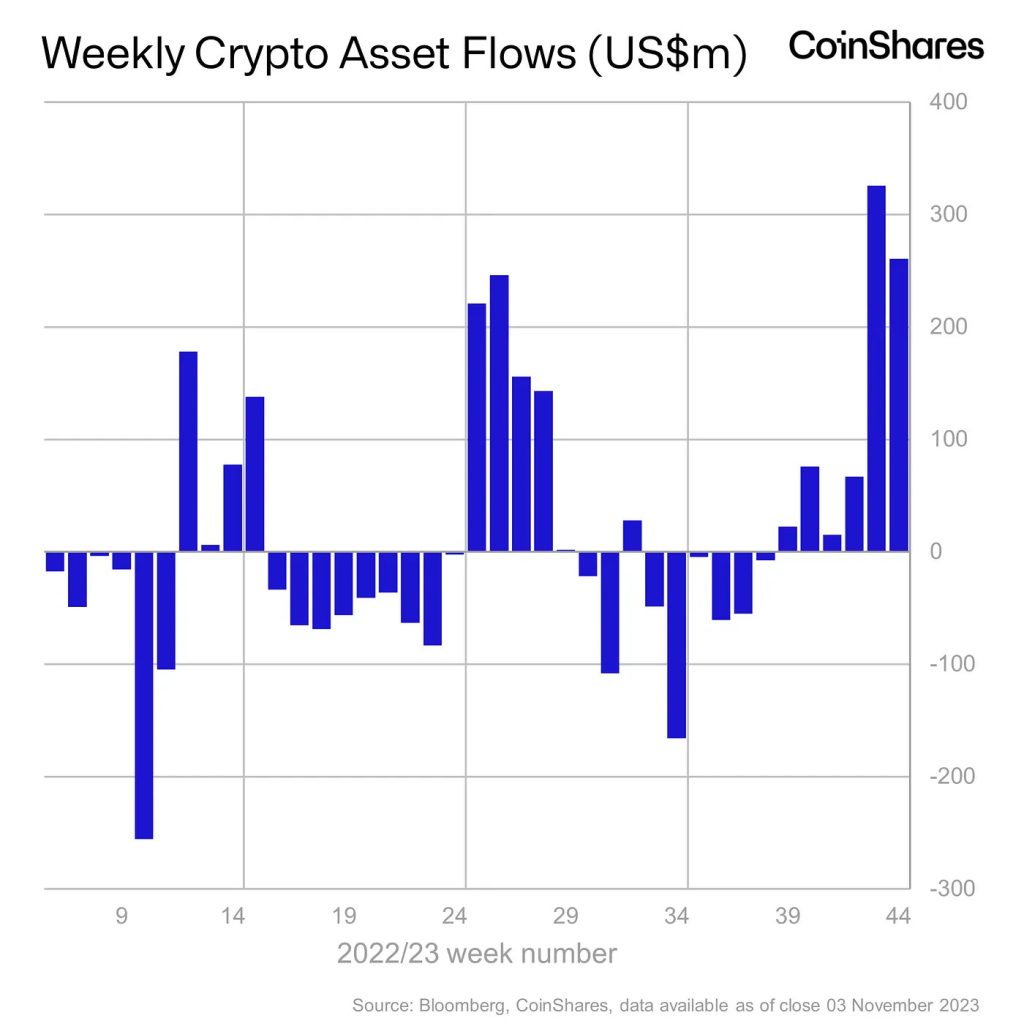

According the latest Coinshares research the digital asset market has continued to attract substantial investment, with products in this category receiving $261 million in the past week.

This influx continues a six-week streak, pushing the total to $767 million, thereby overtaking the annual inflows from the previous year, which were recorded at $736 million. This trend is now on par with the inflow surge from July 2023 and is the most pronounced since the end of the 2021 bull market.

Investment Trends Across Regions and Asset Classes

The United States has become a focal point for these inflows, contributing an impressive $157 million. European regions and Canada are also participating robustly in this inflow trend, with Germany at $63 million, Switzerland at $36 million, and Canada at $9 million.

The recipient of these inflows has been Bitcoin, with a total of $229 million in recent weeks, increasing the year-to-date inflows to $842 million. The prospect of a spot-based ETF in the United States and a critical analysis of the less favorable macroeconomic data have been instrumental in boosting Bitcoin’s desirability. In a contrasting sentiment, there has been an inflow of $4.5 million into short-Bitcoin positions, reflecting a perspective that the recent price rise may be short-lived.

Ethereum has also witnessed a resurgence of inflows, totaling $17.5 million, the highest since August 2022 and a reversal from its earlier outflows of $107 million.

Furthermore, there has been a noticeable inflow into other alternative coins, with Solana attracting $11 million and Chainlink $2 million, which represents 17% of its total assets under management. Smaller yet significant inflows were seen in Polygon and Cardano, with $0.8 million and $0.5 million, respectively, underscoring the growing investor interest across various digital asset classes.