Bitcoin halving happens every four years, reducing the reward for mining new bitcoins by half. This mechanism controls the supply of Bitcoin and potentially increase its value over time. Its date depends on the mining rate but we expect the next halving should take place on April 19 or 20. But how this impact Bitcoin’s price and what are the predictions around it?

Understanding Bitcoin Halving

Bitcoin halving dates back to the cryptocurrency’s inception in 2009, following the 2008 financial crisis. If you are interested in crypto you must know its creator name, Satoshi Nakamoto, the guy or group that is still unknown and stays in the shadow. The creator’s dream was a global digital currency independent of any control control whether it’s a government or a bank. Satoshi capped bitcoin’s maximum supply at 21 million to prevent inflation and make it more valuable as time pass.

Unlike central banks, which can adjust currency supply based on economic needs, Bitcoin’s release follows a predetermined schedule. Satoshi’s plan includes halving the mining rewards roughly every four years, theorizing that reduced supply and increased mining difficulty would enhance bitcoin’s value. So this is Bitcoin halving, the event when mining rewards are halved.

Previous Halving Impacts

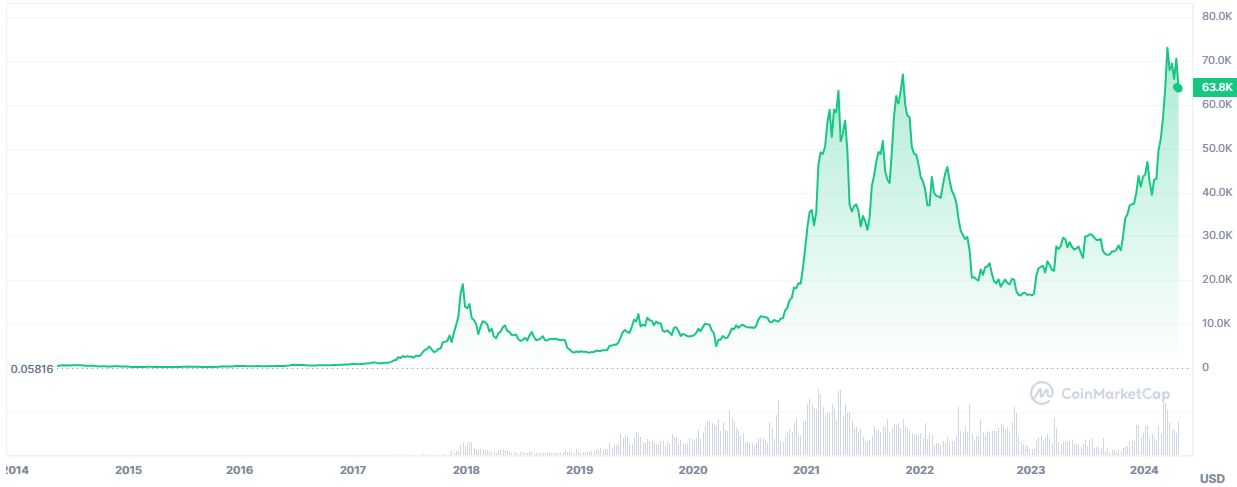

Past halvings have correlated with substantial increases in bitcoin’s price, although this is based on a limited number of events. For example:

- Post the 2012 halving, the price soared from $12.35 to $127 in five months.

- After the 2016 halving, prices doubled to $1,280 in eight months.

- The 2020 halving was incredible at least in total instead of multiplier as it went from $8,700 to over $63,000 by April 2021.

Probably most people think that these price increases are attributed to a growing demand driven by halving-induced excitement, and yes, probably it is, but note that only 3 halvings happened before so the sample size is small. Experts know it, and this is why they caution against assuming direct causation, as other factors, such as market sentiment and global economic conditions, also play significant roles. Just one example: Iran launched a missile attack against Israel on April 13 and Bitcoin’s price dropped 7% almost immediately.

Speculations and Predictions for the Upcoming Halving

It’s possible that the immediate effect of the upcoming halving on bitcoin’s price might be muted. Analysts, including those from VanEck and JPMorgan, suggest that much of the halving impact may have already been priced in, with investors buying in anticipation. This could happened cause of the great news about Bitcoin futures ETFs. As we know SEC approved them in January so a ton of money inflowed into Bitcoin and even the crypto ecosystem. Furthermore, the price might not surge immediately but could experience significant fluctuations as the market adjusts to new supply dynamics. As Adam Sullivan, the CEO of Bitcoin mining company Core Scientific said:

Have we already created the buzz for bitcoin prior to halving—or is the ETF what allows Bitcoin to make similar run ups that we’ve seen in previous halvings? We don’t have to answer that question yet.

Matthew Sigel, head of digital assets research at VanEck, points out, “Given the previous history, the day-of tends to be a non-event for the price.” Similarly, JPMorgan predicts a potential price decline post-halving, citing overbought conditions and comparisons with gold and production costs that suggest a lower boundary for BTC prices around $42,000. This prediction aligns with historical patterns where the price eventually stabilizes around production costs.

Implications for Bitcoin Mining

The halving will also profoundly impact bitcoin miners by slashing their earnings from 6.25 to 3.125 bitcoins per block. This reduction could make mining unprofitable for smaller operations, potentially leading to industry consolidation. Some companies might exit, while others could expand by acquiring smaller players or relocating to regions with lower energy costs to remain viable.

Adam Sullivan, CEO of Core Scientific, comments on the industry’s adaptability,

People are going to operate in a marginally profitable environment for as long as they possibly can. Those are folks that will probably look to get scooped up, probably in the six-to-12 month timeframe.

Matthew Sige also talked about miners:

Miners are always the cockroaches of the energy markets; they’re very nimble. We think the second half of the year will be very strong for bitcoin miners, as long as the bitcoin price rallies.

Conclusion

While the Bitcoin halving is a key event with historical significance for price increases, its impact should be viewed with caution. Market conditions, investor behavior, and broader economic factors will influence the actual outcomes. As the cryptocurrency landscape evolves, so too will the effects of mechanisms like halving. Investors and enthusiasts should monitor these developments closely, considering both the potential gains and the risks involved.