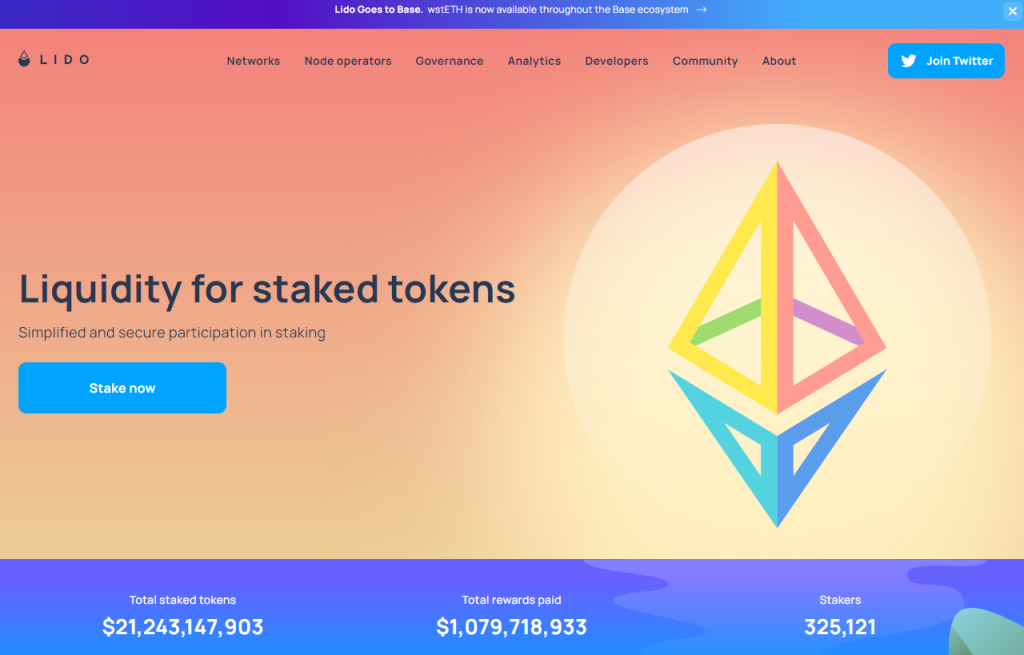

Lido is a platform where you can stake your Proof of Stake tokens like Ethereum, Polygon or Solana without a fix period, as a liquid staking solution. For this you can earn rewards. But what is Lido finance exactly and how does it work? Let’s find out together.

What is Lido Finance?

Lido (LDO) is a staking platform in decentralized finance (DeFi) sector, specifically in the area of Proof of Stake (PoS) consensus mechanisms. PoS is a method used by blockchains to achieve distributed consensus. It allows cryptocurrency holders to stake their assets, actively participating in network operations and earning staking rewards in return. However, traditional staking usually involves locking up assets for a specific period. For example staking on Ethereum blockchain making the assets locked.

Lido allows users to stake their cryptocurrencies, as operating on smart contract blockchains such as Ethereum, Solana, Polkadot or Polygon without the need for maintaining complex staking infrastructure. This flexibility makes it more user-friendly and accessible to a broader audience.

A key innovation introduced by Lido is the concept of “stETH,” or staked Ether. That is the token that stakers receive stETH in return, representing their staked ETH and accruing staking rewards. This token can be used in various decentralized finance (DeFi) applications (DApps), maintaining liquidity and give the holders investment opportunities, unlike traditional staked assets that remain locked and idle.

Lido’s native token is LDO, which plays a dual role. It functions as both a utility token and a governance token, giving holders the ability to influence decisions and policies that guide the Lido ecosystem. This democratizes the governance process, making sure that the platform evolves in line with its community’s needs and preferences.

The History of Lido Finance – Lido DAO

Lido Finance was introduced in October 2020 by a trio of blockchain visionaries: Konstantin Lomashuk, Vasiliy Shapovalov, and Jordan Fish. Lomashuk, the founder and CEO of P2P Validator, a non-custodial staking service established in 2018. Their combined experience and insights into staking services were key in forming Lido’s foundational principles and working strategies.

Following its launch in December 2020, Lido’s journey turned with the transition into a Decentralized Autonomous Organization (DAO). DAO means that the platform’s community has the right to govern the platform in a democratic way. The establishment of the Lido DAO was a strategic move, and it allowed LDO token holders to actively participate in decision-making processes, influencing everything from protocol upgrades to strategic directions. The DAO structure guarantees that Lido remains responsive and adaptable, guided by the its community.

How Does Lido Work

Lido’s advanced technology and user-focused design, makes it an innovative and accessible staking solution.

Staking Mechanism and Distributed Validator Technology (DVT)

Lido’s staking mechanism is an implementation of smart contracts and Distributed Validator Technology (DVT). When users deposit Ether (ETH) or other supported cryptocurrencies into Lido, the crypto asset is aggregated into a staking pool. DVT distributes the staking responsibility network nodes and operators. This distribution increases the security and stability of the liquid staking protocol.

The essence of DVT is to ensure a decentralized and resilient staking environment. By breaking down staking deposits into smaller, more manageable units and assigning them to multiple validators, Lido promotes a wide and secure network and also makes possible for users to earn rewards easily. For example Ethereum’s staking requirements means that a validator must stake at least 32 ETH on the Ethereum network.

The Role of Nodes & The stETH Token

Nodes are fundamental. They do staking operations, participate in validation and blockchain network maintenance. Node operators are selected by different criterial, so only the most reputable and efficient ones are chosen. This selection is managed by the Lido DAO to guarantee transparency and high standards.

Lido issues the stETH token, an ERC-20 token, to represent users’ staked ETH. For every ETH staked through Lido, users receive an equivalent amount of stETH, which reflects both their staked capital and accruing rewards. Unlike traditional staking where assets become locked and aren’t liquid, this token maintains its liquidity and functionality, let the users to trade, transfer, or utilize it in DeFi applications.

Integration with DeFi Ecosystem

The ERC-20 compatibility of stETH makes it a universal asset across different DeFi platforms. Users can use their tokens for different financial activities, such as receiving loans or participating in yield farming, maximizing the potential of their staked assets.

What is LDO Token?

The LDO token is the native utility and governance token of the Lido platform. Designed as an ERC-20 token, LDO is more than a digital asset, it represents the participation and democratic philosophy in the Lido ecosystem. It was launched in January 2021 and had a total supply of 1 billion.

LDO token is to allow decentralized governance. Holding LDO grants users voting rights in the Lido DAO. This means LDO holders can participate in important decisions regarding the Lido protocol, such as proposing or voting on changes to the protocol, adjustments in fee structures, and decisions about the overall direction of the project.

LDO also serves motivation for holders. It is used to reward various participants, including node operators and liquidity providers. These rewards are designed to promote continued participation and investment in the Lido ecosystem.

How to Use LDO?

Using LDO involves several practical applications:

- To participate in governance you can vote on proposals. For this you have to connect your wallet containing LDO tokens to Lido’s governance portal and casting your vote on proposals.

- By participating in the ecosystem, either as a node operator or by contributing to liquidity pools, you can earn LDO tokens as rewards.

- LDO can be staked or invested in DeFi platforms to earn additional yields. As an ERC-20 token, LDO is compatible with a lot of DeFi protocols.

- You can also trade these tokens, however in the US trading LDOs there isn’t available. Most of the crypto exchanges accept these tokens whatever if it’s centralized or decentralized. So you can buy, sell, or exchange LDO.

How to Stake Tokens – What is Liquid Staking and Staking Yield

Liquid staking provides you with a liquid token (like Lido’s stETH) in exchange for your staked assets on a 1:1 basis.. This means you can continue to use the value of your staked assets in other DeFi applications, maintaining liquidity and flexibility while still earning staking rewards.

Exploring Staking Yield

Staking yield refers to the rewards earned from staking your cryptocurrencies. In Lido’s case, these yields are distributed in the form of additional stETH tokens, representing the rewards accured over time. The yield rate depends on several factors, including the overall performance of the PoS network you’re staking on and the total amount of staked assets within the network. It’s important to note that staking yields can fluctuate based on network conditions and demand.

Staking with Lido not only simplifies the staking process but also maximizes the potential of your assets. By offering liquid staking and competitive yields, Lido ensures that users can make the most out of their investments without sacrificing liquidity or flexibility.

Staking Process

Staking tokens is a straightforward process via Lido.

- Choosing a Token: The first step is to choose the cryptocurrency you wish to stake. You can stake for example Ethereum, Polygon or even stake Matic tokens as Lido supports a wide range of tokens.

- Connecting a Wallet: Connect your wallet, such as MetaMask, to the Lido platform. This wallet should contain the tokens you want to stake. Click here for a detailed article about crypto wallets.

- Staking: Once connected, you can stake your tokens directly through Lido’s interface. The platform will then pool your tokens with those of other users.

Featured image source: coinpage