Solana is a smart contract platform like Ethereum, offering create smart contract capability on its blockchain. Solana uses Proof of History (PoH), which is its consensus mechanism, and a new way to authenticate transactions’ timeline without traditional, time-consuming methods. Among other things, it achieves fast transactions on its own network.

What is the Solana Cryptocurrency and How Does it Work?

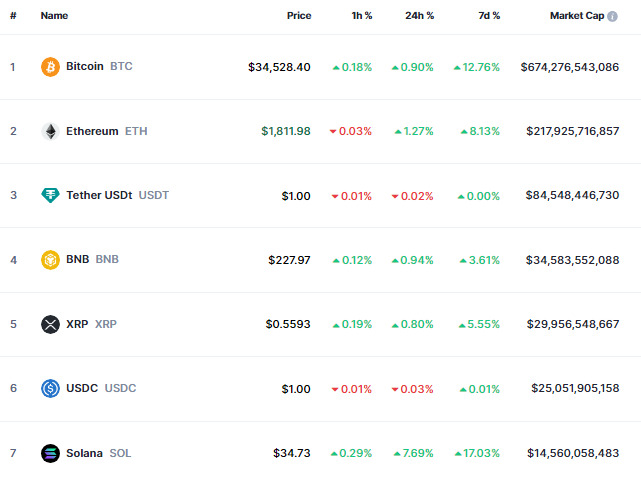

Solana is an open source decentralized blockchain network with fast, secure and scalable transactions. The idea was conceived by Anatoly Yakovenko in 2017, but it was officially launched just in 2020. It uses SOL token as its native cryptocurrency. At the date of writing it’s on the 5th place of the crypto market according to coinmarketcap.com with a total market capitalization of around $83 billion.

It’s able to run decentralized applications (DApps) through smart contracts in addition to peer-to-peer transactions. What makes this crypto platform quite unique is the Proof-of-History (PoH) mechanism. This is one of the reasons why it is possible to carry out many more transactions on the blockchain compared to Ethereum. But what is this Proof-of-History?

Proof of History

Proof-of-History (PoH) is a consensus mechanism that allows quick and efficient verification of transaction timestamps. You may ask, OK, but why is this so “revolutionary”? Well, if you think about it, it is typical that software uses the computer’s own clock for the current time, which means that time as a distinguishing criterion cannot work. After all, nodes can be globally dispersed in different time zones. However, to overcome this, Yakovenko created Proof-of-History as a solution by creating a single timestamp on the blockchain.

Understanding Solana’s Consensus Mechanism

Now that you know the PoH, it will be easier to understand the mechanism of the Solana consensus. It’s a complex solution, because Proof-of-History is used alongside Proof-of-Stake. Proof-of-Stake tries to secure against attacks on the network by having validators perform the verification of transactions. The validators are required to deposit an “eyeball” amount on the blockchain, which they risk in the event of an attack.

However, in addition to the combination of the two proof procedures mentioned above, Solana also uses Tower BFT (Byzantine Fault Tolerance). This consensus mechanism allows the blockchain to work even when some validators fail or are malicious. It basically achieves this by putting validators in groups, each with a leader. These lead validators are responsible for authenticating transactions and creating blocks. If the lead validator in a tower fails or is malicious, the transaction is moved to the next closest group. The group then elects a new leader.

With these three solutions, Solana aims to deliver unparalleled speed, security and scalability to users of the platform.

Solana: a Cryptocurrency Platform for Decentralized Applications (DApps)

As I mentioned earlier, the Solana network can also provide so-called smart-contracts. These are basically contracts that are automated and are created when the desired conditions are met. So let’s see the benefits of Solana!

Key Metrics & Benefits of Solana

One of the most outstanding features of Solana is its high throughput. By leveraging its unique hybrid consensus model, Solana can effortlessly handle thousands of transactions every second. This speed is pivotal for applications that thrive on high transactional throughput, such as advanced financial platform or intricate gaming dApp. That means it’s the place for DEX (Decentralized Exchange) crypto trading platforms.

However, speed isn’t the only forte of Solana. While many popular blockchains can become hamstrung with escalating fees during times of peak usage, Solana ensures that transaction costs remain modest. This affordability, even under heavy network traffic, becomes an invaluable asset for both developers and end-users.

Furthermore, Solana’s promise hasn’t gone unnoticed. The platform has rapidly caught the attention of a multitude of developers, resulting in a thriving ecosystem brimming with dApps, decentralized finance (DeFi) platforms, and innovative NFT projects. This flourishing environment further solidifies its value proposition and standing in the blockchain domain.

Real-World Applications of Solana

A glance at the decentralized finance, or DeFi, landscape reveals Solana’s undeniable footprint. The scalability and speed inherent to Solana make it a great place for DeFi platforms. Several of these protocols, whether they started on Solana or migrated over, offer a lot of services ranging from lending and borrowing to intricate yield farming mechanisms.

But it’s not just about DeFi. Non-Fungible Tokens (NFTs) on Solana are expanding. Artists, creators, and innovators are increasingly drawn to its ecosystem, motivated by the low minting and transaction fees. From digital art masterpieces to rare collectibles, Solana’s NFT marketplaces create a way to these arts to trade.

Moreover, the gaming industry, especially Web3 gaming, demands rapid transaction times combined with negligible fees. Solana, with its capabilities, is the platform of choice for an array of blockchain-centric games. Additionally, the world of Decentralized Exchanges (DEXs) on Solana, represented by platforms like Serum, takes full advantage of the network’s transactional throughput, offering users a seamless and efficient token swapping experience.

Solana vs Ethereum

If you’ve heard of Ethereum, you might be wondering why Solana is different from Ethereum. Let’s see.

As we have shown, Solana uses a combination of PoS and PoH mechanisms for validation. In contrast, Ethereum initially used Proof of Work and later switched to PoS, improving speed somewhat. However, Solana currently far outperforms Ethereum in terms of speed, price and volume. Ethereum’s network can process about 15 transactions per second for an average of $1.68, while Solana can process roughly 50,000 transactions for an average of $0.00025.

Of course, transaction fees can vary depending on the load on the network, but it is conceivable that Solana charges a really low price. While this Ethereum network uses ETH as its native coin to pay these fees, Solana uses its own native coin, SOL.

SOL as an Investment – Solana Price Fluctuation in 2022 and 2023 – The FTX Saga

Perhaps our article has sparked your interest in Solana. At the date of writing according to the site of Coinmarketcap Solana USD price is $34.45 and its all-time high was at $260.06 in 2021, November. While the exchange rate of SOL BTC is 0.0011387 BTC, and sure, Bitcoin‘s still the leader of the crypto market with it’s recent price of $34,390. From this perspective, let’s see what the Solana has to offer and what happened with it recently.

Events That Caused Solana Price Change in 2022-2023

In November 2022, there was considerable excitement in the blockchain community when Google Cloud entered into a partnership with Solana. Google Cloud announced its new role as a validator on the Solana blockchain. This collaboration signaled broader horizons for Solana, especially with Google Cloud’s decision to integrate its Blockchain Node Engine with the platform by 2023, aiming to simplify the task of running a Solana node.

Further elevating Solana’s profile, Nalin Mittal, Google Web3 product manager, revealed that Solana data would be indexed and added to Google’s BigQuery data warehouse by the first quarter of the following year. This integration was designed to grant Solana software engeeniers easier access to historical data. Alongside these advancements, Google Cloud launched an incentive program offering significant Cloud Credits to select Solana ecosystem startups.

However, just a few months later in February 2023, the optimism surrounding Solana was slightly dimmed by reports of technical difficulties. Users faced challenges in trading digital assets, leading to concerns about the network’s stability. While SolBlaze, a prominent staking pool on Solana, confirmed that the blockchain hadn’t completely shut down, it highlighted delays stemming from a significant forking event on its Mainnet-beta. Amid the technical challenges, market reactions were swift, with Solana’s SOL price dipping by 5%, settling at an average value of $22.77. Speculations arose about the recent v1.14 upgrade being a potential culprit for the ongoing issues.

The network’s troubles persisted. Solana users found themselves in the midst of a protracted service outage. What began as minor hitches in transaction processing had spiraled into a nearly comprehensive shutdown of the Solana network. Despite the best efforts of validators and developers, a synchronizing restart and chain fork to restore service to the platform proved unsuccessful on the initial attempt. Users were left in limbo as their on-chain crypto assets remained frozen, accentuating the severity of the technical glitch. The network was in the process of making a second restart attempt, with the hope of finally resolving the ongoing crisis.

From a promising partnership with Google Cloud to technical setbacks that challenged its stability and market value, Solana’s journey over these few months was nothing short of eventful. But finally Solana Foundation solved the problem so it’s working well now.

Sam Bankman Fried and FTX – The Impact on SOL and Bitcoin Price in 2022

In addition, the Solana cryptocurrency token experienced a significant decline, dropping by 94.2% in 2022. This drop was intensified by the collapse of FTX, one of the world’s largest crypto exchanges. Even though Solana had a limited direct link to FTX, its association with FTX founder Sam Bankman-Fried, who is facing criminal charges for fraud, negatively impacted its value. Bankman-Fried had frequently praised Solana, and both FTX and his trading firm Alameda held Solana tokens.

Since the onset of the FTX controversy on Nov. 2, Solana’s value decreased by 51.14%, while ether and Bitcoin fell by 21.3% and 17.6%, respectively. Another token, Serum (SRM), associated with Bankman-Fried and built on the Solana blockchain, also dropped 80.5% since Nov. 2. The overall cryptocurrency market capitalization is currently at $798.4 billion, down from its November 2021 peak of over $3 trillion.

What Does Solana Crypto Offers for an Investor

You can see that Solana’s journey is not exactly smooth. However, all the problems have been solved so far and it is currently proving to be one of the best smart-contract platforms. So let’s summarise why the platform of Solana Labs platform is outstanding and promising.

- The Fundamentals: Solana’s unique technical infrastructure, particularly its Proof-of-History mechanism combined with Proof-of-Stake, offers a different kind of assurance for investors. Its ability to handle a vast number of transactions simultaneously without congesting the network underpins its intrinsic value. Moreover, the consistent development within the Solana ecosystem, including partnerships, DApps, and other integrations, indicates a robust and thriving platform. A thriving platform often translates to a robust demand for its native token, in this case, SOL.

- Growing Ecosystem: An active ecosystem can be an indicator of a cryptocurrency’s long-term value. As developers continue to build on Solana, the demand for SOL is likely to increase. This growing demand can lead to a price appreciation for SOL.

- Adoption Rate: The rate at which new projects and developers are migrating to or launching on Solana can be a proxy for its future value. Its low transaction costs and scalability make it attractive for developers, which in turn can lead to a higher demand for SOL as more users interact with the platform.

- Market Sentiment: Like all cryptocurrencies, SOL’s price influenced by market sentiment. Positive news about Solana can lead to increased demand for SOL, while negative news or regulatory challenges can affect its price adversely.

- Diversification: For those already invested in other cryptocurrencies like Bitcoin or Ethereum, adding SOL to one’s portfolio can provide diversification. Different blockchains have different use cases, and the success of Solana doesn’t necessarily correlate directly with the success of other platforms.

- Accessibility: Acquiring SOL is easy, as many major cryptocurrency exchanges the coin, allowing potential investors easy access to the coin. After making an account like on Binance, you are ready to purchase SOLs.

Every investment carries inherent risks, and it’s always advisable to consult with financial experts or do in-depth research before making any investment decisions. Remember, the world of cryptocurrency is volatile, and while the rewards can be high, the risks are equally significant.

Featured image source: videolista